Lanka IOc Growth

Lanka IOC PLC saw net earnings surge 65% to Rs 4.81 billion for the year ended 31 March 2014, up from Rs 2.91 billion a year ago, financial results filed with the stock exchange showed.

Sales grew 8.9% to Rs 81.8 billion and gross profit grew 54.22% to Rs 8.31 billion.

Selling and distribution expenses amounted to Rs 1.74 billion, up from Rs 1.67 billion a year ago, administration expenses fell to Rs 875.3 million, down from Rs 889.1 million the previous year. Finance income grew to Rs 301 million, up from Rs 267 million a year ago and finance costs grew to Rs 258.5 million, up from Rs 138.8 million the previous year.

The company’s assets grew 9.24% to Rs 26.98 billion.

Export sales fell to Rs 12.84 billion during the year ended 31 March 2014, down from Rs 18.12 billion a year ago.

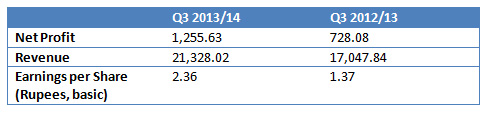

COLOMBO, (Reuters) – Group results for Lanka IOC PLC, the Sri Lankan arm of Indian Oil Corp, for the three months ended Dec. 31, released recently. (in millions of rupees unless otherwise stated):

NOTE – Results are provisional and unaudited.

- Foreign investors and funds hold 77 percent of the tota issued shares in the company, which has a market cap of 20.24 billion Sri Lankan rupees ($154.80 million) and accounts for 0.79 percent of the total market capitalisation of the stock exchange, latest bourse data showed.

- The parent, Indian Oil Corp, holds 75.12 percent of the shares in its Sri Lankan arm.

- Shares in Lanka IOC have gained 35.1 percent in the December quarter and 19.3 percent so far this year.

(Reporting by Ranga Sirilal and Shihar Aneez; Editing by Sunil Nair for Reuters)

Complete results can be downloaded from our Investor Section.

A substantial decrease in finance costs enabled Lanka IOC PLC (LIOC) to post a net profit of Rs.805.9 million for the three months ended March 31, 2013 (4Q12) as against Rs.42.6 million during the corresponding period of the previous year, interim financials released to the Colombo Stock Exchange revealed.

Accordingly finance costs fell from Rs.870.8 million during the final quarter of 2012 to Rs.28 million during the quarter under review.

A further increase in finance income, which was Rs.106.4 million during the period in consideration in comparison to Rs.25.3 million during 4Q12, also contributed to the growth of the company’s bottom line.

Revenue for the quarter fell to Rs.19.2 billion from Rs.19.4 billion a year earlier and cost of sales fell to Rs.17.7 billion from Rs.17.8 billion and gross profits fell to Rs.1.44 billion from Rs.1.6 billion. Gross profits fell to Rs.790 million from Rs.895 million.

Also LIOC’s income tax expenses increased during the quarter under review to Rs.63.2 million as against Rs.7.8 million during the corresponding period of 2012.

Earnings per share (EPS) for the quarter ended March 31, 2013 stood at Rs.1.51 as opposed to 8 cents during the quarter ended March 31, 2012.

Meanwhile for the year ended March 31, 2013 the company recorded a net profit of Rs.2.9 billion as against Rs.905.9 million during the previous year.

During the year under review too finance costs fell from Rs.1.1 billion to Rs.138.8 million while finance income too increased from 78 million to Rs.267 million.

LIOC is a unit of India’s state controlled oil major, Indian oil Company

Profits at Lanka IOC the second fuel distributor in Sri Lanka surged to 1.39 billion rupees in the June 2013 quarter from 191 million rupees a year earlier.

The firm reported earnings of 2.53 rupees per share in the quarter. Revenues dropped to 18.4 billion rupees in the June 2013 quarter from 18.6 billion rupees a year earlier and cost of sales dropped faster to 16 billion rupees from 17.4 billion, almost doubling gross profits to 2.4 billion rupees from 1.26 billion.

Managing director said revenues dropped because bunker sales were weak in the quarter, lubricant volumes were up and costs were kept down. “We optimized our purchases though procurements,” he said.

Oil prices have been moderate during the period, he said.

Finance costs fell to 251 million rupees in the quarter from 442 million rupees a year earlier.

The Lanka IOC said a stronger exchange rate in the June quarter helped bring down finance costs but in the September quarter a weaker exchange rate will push up costs.

Lanka IOC PLC as one of the leaders in Sri Lanka Oil Companies had a Rs 2.83 billion net profit for the six months ended 30 September 2013, up from Rs 1.37 billion a year ago, interim financial results filed with the stock exchange showed.

Revenue for the six-month period increased to Rs 39.23 billion, up from

Rs 38.86 billion a year ago.Distribution costs fell to Rs 855.75 million, down from Rs 889.24 million a year ago.

Finance income grew to Rs 100.98 million, down from Rs 51.3 million and finance costs increased to Rs 309.49 million, up from Rs 155.84 million a year ago. Basic earnings-per-share amounted to Rs 5.32, up from Rs 2.58 a year ago