Sri Lanka Oil Companies

An exciting business opportunity to partner a progressive company.

LANKA IOC PLC invites applications to appoint Bitumen Credit Facilitator for Sales of Bitumen in Sri Lanka. Lanka IOC PLC is an overseas venture of Indian Oil Corporation Ltd which is a Fortune “Global 500” company. Currently operates 169 petrol sheds and markets Bitumen throughout the island in the road construction industry. It is one of the leading listed companies in Sri Lanka with a turnover USD 650 million during the year 2013-14.

LIOC is one of the largest Bitumen selling Companies in Sri Lanka. LIOC is looking for credit facilitator with sound financial background capable of investing 100-200 million and who can canvass for bitumen business. In this respect the selected party should be able to offer credit to customers identified by LIOC. Necessary credit facilitation fee will be paid by LIOC for this purpose.

A physical Application form can be collected from Lanka IOC Head Office at Colombo on all working days between 9:00 Hrs to 16:00 Hrs or downloaded from our company web site free of charge and completed application should be submitted on or before 15:00 hours 06.01.2015.

You may also download the Application online.

Bitumen Credit Facilitator – Application Form

For further information please contact:

SR.VICE PRESIDENT – LUBES (M & P)

LANKA IOC PLC

LEVEL 20, WEST TOWER

WORLD TRADE CENTRE

COLOMBO – 01

The Chairman of Lanka IOC Plc (LIOC), Makrand Nene says it is of great importance that the Sri Lanka Government evolves a transparent pricing system for fuels which would not only benefit the public but would also pave way for systematic infrastructure development in the energy sector. According to the LIOC management, there remains minimal correlation of local prices to International world market prices, which exposes the industry to an acute risk of incurring significant financial losses due to sudden price fluctuations. Hence, they say there is a need for greater transparency in the formulation of a method to correlate to global prices.

Addressing shareholders at the release of the company’s Annual Report for the year March 31, 2014, the LIOC Chairman Nene said that 2013/2014 had been the most successful financial year to date, as the firm continued to grow in its second decade of operations as the second and only other player in the Sri Lankan petroleum sector next to Ceylon Petroleum Corporation (CEYPETCO).

“With the Ceylon Petroleum Corporation having finally increased their diesel selling price in line with Lanka IOC in February 2013, our retail sales of diesel grew by 41% in quantity and 46% in value this financial year,” Nene announced adding that the company has achieved Rs.81.79 billion in sales, up 9% from Rs.75.11 billion recorded in the previous year.

Lanka IOC Plc has thus recorded a profit after tax of Rs.4.8 billion for the financial year, up from Rs.2.9 billion reported in the corresponding period of the previous year.

Domestic revenue for the year has increased by Rs.11.95 billion, which is a 20.9% growth from the previous year with the largest contribution from diesel sales which increased by 53%. Petrol revenue only grew by 8% but it contributed 40% of the total revenue, financials showed.

Meanwhile, Managing Director Subodh Dakwale said LIOC continued to expand its retail sector in 2013/14, opening ten new outlets in locations where fuel filling stations were most needed, increasing its number of filling stations to 147 and refurbishing a number of existing stations.

“In 2014/15, however we plan to kick start our expansion drive by opening over forty new outlets and refurbishing a further fifty. We plan to spread our footprint across the country in a major way, by increasing our presence in the unrepresented areas of the island nation,” he announced.

LIOC said in the financial year 2013/2014, fuel products had continued to be their highest profit center, garnering 75% of the total profit and accounting for 73% of the total turnover. Sales of petrol grew by 3% in 2013/14 to over 200,000 kiloliters while with price parity finally being reached, diesel sales grew by an incredible 41% to over 222,000 kiloliters.

On the corporate end, LIOC said acquisition of the business during the period under review to supply lubricant products to the Sri Lanka Transport Board can be counted upon as a major achievement.

In the year 2013, although value of total oil imported into Sri Lanka grew up to Rs.182 billion from Rs.157 billion in 2012, the value of refined products imported reduced to Rs.353 billion from Rs.467 billion. Nonetheless, the oil prices remained unchanged within the year and sales of petrol grew by 4% and diesel grew by 2%.

Lanka IOC PLC recently opened their 100th ‘SERVO Shop’ in Mawanella. In 2013, LIOC put this innovative idea forward to further increase its stake in the lubricant market and re-conceptualized its retail channel with a unique new concept to showcase LIOC’s range of Servo lubricants Sri Lanka.

Lanka IOC PLC recently opened their 100th ‘SERVO Shop’ in Mawanella. In 2013, LIOC put this innovative idea forward to further increase its stake in the lubricant market and re-conceptualized its retail channel with a unique new concept to showcase LIOC’s range of Servo lubricants Sri Lanka.

Starting from left, Kegalle Distributor, Mediwatte; Lubes Executive- Retail, Rasheel Hassen; Lubes Marketing and Planning Senior Vice President, Soumen Ganguly; Lanka Servo Shop Dealer, Najimudeen and Kandy Region Sales Supervisor, Sanjaya are present in this picture.

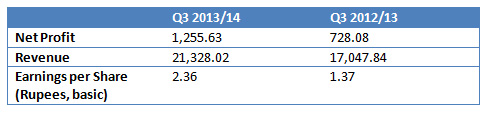

COLOMBO, (Reuters) – Group results for Lanka IOC PLC, the Sri Lankan arm of Indian Oil Corp, for the three months ended Dec. 31, released recently. (in millions of rupees unless otherwise stated):

NOTE – Results are provisional and unaudited.

- Foreign investors and funds hold 77 percent of the tota issued shares in the company, which has a market cap of 20.24 billion Sri Lankan rupees ($154.80 million) and accounts for 0.79 percent of the total market capitalisation of the stock exchange, latest bourse data showed.

- The parent, Indian Oil Corp, holds 75.12 percent of the shares in its Sri Lankan arm.

- Shares in Lanka IOC have gained 35.1 percent in the December quarter and 19.3 percent so far this year.

(Reporting by Ranga Sirilal and Shihar Aneez; Editing by Sunil Nair for Reuters)

Complete results can be downloaded from our Investor Section.

Lanka IOC PLC had a Rs 2.83 billion net profit for the six months ended 30 September 2013, up from Rs 1.37 billion a year ago, interim financial results filed with the stock exchange showed.

Revenue for the six-month period increased to Rs 39.23 billion, up from

Rs 38.86 billion a year ago.Distribution costs fell to Rs 855.75 million, down from Rs 889.24 million a year ago.

Finance income grew to Rs 100.98 million, down from Rs 51.3 million and finance costs increased to Rs 309.49 million, up from Rs 155.84 million a year ago. Basic earnings-per-share amounted to Rs 5.32, up from Rs 2.58 a year ago

Lanka IOC PLC, unveiled a range of new age lubricants in the presence of a large gathering of customers from the automobile industry, OEM representatives, trade partners and distributors at a colourful ceremony at the ‘Atrium’ of Cinnamon Grand Hotel. Following the launch of Servo Futura range of lubricants consisting of SERVO Futura Synth, SERVO Futura P, SERVO Futura P Plus, and SERVO Futura D, Lanka IOC PLC Managing Director, Subodh Dakwale, said the launch today marks a distinct technological milestone in the 40 year history of brand ‘SERVO’.

Speaking further he said: “SERVO Futura meets the latest international specifications of American Petroleum Institute, Volvo and Mercedes Benz, besides the latest European specifications. With the launch of SERVO Futura Synth Lanka IOC now joins the select brands of premium global lubricants that offer fully synthetic engine oils.”

The top-end offering SERVO Futura Synth is a 100% synthetic premium lubricant that is formulated from performance enhancing Polaphoalefins group-IV base oils and additives that are classified by the American Petroleum Institute (API). SERVO Futura Synth meets the most advanced performance level standards of API SN, with 5W-50 viscometrics ensuring improved mileage and excellent engine performance. The product offers outstanding protection to engine, besides, enhanced engine life through its effective anti-wear capabilities.

SERVO Futura P+, a hybrid synthetic oil meeting the highest specifications of API SN, is another superior engine oil as also are SERVO Futura P and SERVO Futura D – for petrol and diesel engines respectively.

SERVO Futura range of lubricants are a unique combination of products and services that enable users to combine high quality maintenance and reduced operating costs for materials. It is the smart solution for people who want to simplify the maintenance of their car. It caters to an entire range of new generation vehicles and the advantage of Futura is that it clings to the piston and works even when the engine is not running. It shields the engine’s crucial components even when it’s off providing round-the-clock protection for your car’s engine. The superior polar chemistry ensures cleaner engine, provides enhanced engine life and lower maintenance cost.

SERVO with more than a 40% share in the Indian market of approximately 1.4 million metric tonnes served by more than 40 lubricant companies which include all of the world’s leading brands, is fast becoming Sri Lanka’s preferred choice of lubricants ahead of its competitors due to the unmatched quality and range of its products. Today, SERVO is the second largest selling brand in Sri Lanka. Continued availability resulting from a wide distribution network further fortifies its stake in the market as a major player. SERVO’s attention to detail also ensures that venturing into new explorations, collaborations and relationships are consistently carried out in accordance with the company’s vision of providing unrivaled product and service excellence. Recently LIOC has commenced manufacturing group II based diesel engine oils meeting API CH4 specification in its plant in Trincomalee. LIOC has launched the concept of SERVO Shops which are exclusive shops for marketing SERVO range of lubricants.

Speaking on this occasion Dakwale, further said, “Being a market leader, we have a keen eye on the ever changing dynamics of the market. Rising oil prices and the ever-growing demand for environment protection has resulted in the industry seeking energy-efficient and less polluting engines. In turn this has pressurized oil manufacturers into delivering absolutely cutting-edge products.”

He further stated that for more than 40 years SERVO has worked assiduously to earn the trust of man and the respect of machine. Working deep inside the crankcase of high-speed engines where massive heat is generated and friction can cause engines to seize, SERVO has discharged an important responsibility with self-belief and commitment. Today, it symbolizes innovation, technology, reliance and value.

Lanka IOC PLC is the overseas venture of IOC India, a Fortune 500 company. It is the only private oil company other than the state-owned Ceylon Petroleum Corporation (CPC) that operates over 150 retail petrol/diesel stations in Sri Lanka and has a very efficient lube marketing network. Its major facilities include an oil terminal at Trincomalee, Sri Lanka’s largest petroleum storage facility and an 18,000 tonnes per annum capacity lubricant blending plant and state-of-the-art fuels and lubricants testing laboratory at Trincomalee. With a powerful compilation of energy brands in addition to the SERVO brand of lubricants including, ‘XtraPremium Euro III Petrol, XtraMile Diesel’ strengthening its portfolio, IOC India has also paved the way for Lanka IOC to achieve a turnover of Rs 60.4 billion.

His Excellency Mr Ashok K Kantha, Hon’ble High Commissioner of India in SriLanka launched Corporate Fuel card and XtraPremium Euro 3 at M/s Felix Perera, flagship Retail Outlet of Lanka IOC.

The launch took place on 01.02.2012 in presence of Mr Sudhir Bhargava, Additional Secretary MOP&NG, Govt of India, Mr M Nene, Chairman Lanka IOC, Dr Hans Wijayasuriya, Group CEO Dialog and Mr K R SureshKumar, Managing Director, Lanka IOC. CEOs of many companies in SriLanka were also present at this function to witness the launch of Corporate Fuel Card which is the first of its kind in SriLanka and provides solution to the fuel requirement of Corporates without going through intermediaries.

Corporate Fuel card has been launched by Lanka IOC with a tie up with Dialog. Under this scheme, cards will be issued to the corporate bodies which can be used for taking fuel from Lanka IOC Petrol sheds. The respective Corporate may assign different limits to the individual cards through web based solution provided by Dialog. This will help the Corporate bodies to do away with processing of reimbursements to individual employees, tracking fuel consumption and convenience of settling the payment directly with Lanka IOC.

M/s Dialog in strategic partnership with Lanka IOC will provide necessary hardware at the Retail outlets and will provide web based interface for all the Corporates and dealers of Lanka IOC.

Lanka IOC donates ambulance to Mahadivulwewa Hospital in Trincomalee district

November 22, 2013 6:56 am

Lanka IOC PLC a leader among Sri Lanka oil companies completed 10 years of business operation in 2012, and to commemorate its anniversary Lanka IOC lined up various CSR activities benefiting the community where the company has its branches. One such community-based service took place on 24 June 2013 at Hotel Taj Samudra premises.

Lanka IOC donated an ambulance to the Divisional Hospital in Mahadivulwewaa, Trincomalee hospital provides healthcare services for over 10,000 people in that area and to transfer a patient to the General Hospital in Trincomalee, it takes more than an hour; the estimated distance is around 40km. Looking into this longstanding requirement of this remote area, Lanka IOC came forward to donate the ambulance.

LIOC Managing Director, S. Dakwale in his address stated that LIOC is committed to helping the needy and poor people and providing them better services to uplift their life in future.

Addressing the 10th Annual General Meeting (AGM) of Lanka IOC held at Colombo. Mr.M.Nene Chairman Lanka IOC and Director (Marketing), Indian Oil said, “Lanka IOC will continue to play a key role in energizing and enriching the nation, supporting the endeavor of the Government of Sri Lanka, for developing the nation into a strategically important economic power in the region, under the forward-looking leadership of H.E. President of Sri Lanka.” He also added that Lanka IOC has made remarkable progress in the very first decade of its operations in Si Lanka. World-class fuels are now being offered to our valued customers in Sri Lanka for use in new generation vehicles that are increasingly popular in Sri Lanka.

With reference to the companies financial status, Mr.Nene said,”The turnover of Lanka IOC for the financial year 2011-2012 touched Sri Lanka Rs.60.4 billion while profits stood at Rs.930 million. He signed off thanking the valued shareholders for their support and promising that Lanka IOC would continue to work towards achieving energy security in Sri Lanka while focusing on offering world-class technology, products and services as part of the Company’s customer-oriented growth agenda.

Lanka IOC PLC as one of the leaders in Sri Lanka Oil Companies had a Rs 2.83 billion net profit for the six months ended 30 September 2013, up from Rs 1.37 billion a year ago, interim financial results filed with the stock exchange showed.

Revenue for the six-month period increased to Rs 39.23 billion, up from

Rs 38.86 billion a year ago.Distribution costs fell to Rs 855.75 million, down from Rs 889.24 million a year ago.

Finance income grew to Rs 100.98 million, down from Rs 51.3 million and finance costs increased to Rs 309.49 million, up from Rs 155.84 million a year ago. Basic earnings-per-share amounted to Rs 5.32, up from Rs 2.58 a year ago